What is Swap and how does it work

So you have heard the terms swaps and are wondering how it works.

Basically swap is interest.....the same as you pay on any load be it auto loan or mortgage, etc.

How does this apply to forex trading, you ask.

Let's consider a trade that you wish to make, and I will use a 1 lot EURZAR as an example. In your trading account you have $10 000 and account leverage is 1:100.

When you trade 1 lot, you will be using 100 000 Eur to buy ZAR(Remember we are selling EUR so this means we are getting ZAR in return). The broker will "virtually" lend you the EUR. Of course, the broker isn't physically going to lend you the money.....they whole process is transparent or invisible to you.....all you see is the profit or loss. Just because you cannot see the process, doesn't mean that it doesn't happen.

Your broker will expect you to put something on the table.....the margin. Since your leverage is 1:100, you need to put 1000 eur on the table. This is about $1 180 depending on the EURUSD exchange rate. You will notice at the bottom of your trading platform it will say Margin :1 180. That is just a technical requirement so that you don't end up making trades of unlimited size.

Since we have borrowed 100 000 eur from your broker, of course, like any other loan, you need to pay interest on this loan. The current lending rate of the ECB is around 0.25%. which is 250 Eur per year, or 0.68 eur per day.

The trade is executed and you collect ZAR....1 574 000 at the time of writing(EURZAR rate). Of course now you are holding ZAR.....because you are holding the funds, which the broker holds for you, they pay interest to you. The overnight FX rate for the ZAR is 7.25%, so you collect R114 115 per year, or R312.64 per day. Converted back to EUR is 19.86. Now you can easily see that the difference between what you are paying and what you receive is 19.18 eur or converted to USD = $16.25.

So you are being paid $16.25 per lot for each day of open EURZAR trade that you carry. In fact, they call this the carry trade. It is a valid trading strategy. Of course the broker may take a cut and only offer you $13 and you can be sure that on the reverse trade ie BUY EURZAR instead of SELLING, then the broker will charge you far more than $16.25, probably more like $25 that you will pay the broker.

Also, just to be clear, swaps are not related to the profitability of the trade. If the trade has open profit or loss does not affect the swap collected or paid.

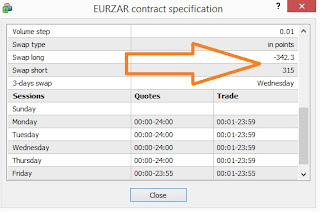

You can see the swaps in Metatrader 4 by right clicking on any currency, select Specification and scrolling down to swaps.

Swaps are quotes in points or in USD. I won't get into the complexity of calculating the actuals swaps but in the above example, you can clearly see that the broker charges more for long swap than what they pay for short swap.

Basically swap is interest.....the same as you pay on any load be it auto loan or mortgage, etc.

How does this apply to forex trading, you ask.

Let's consider a trade that you wish to make, and I will use a 1 lot EURZAR as an example. In your trading account you have $10 000 and account leverage is 1:100.

When you trade 1 lot, you will be using 100 000 Eur to buy ZAR(Remember we are selling EUR so this means we are getting ZAR in return). The broker will "virtually" lend you the EUR. Of course, the broker isn't physically going to lend you the money.....they whole process is transparent or invisible to you.....all you see is the profit or loss. Just because you cannot see the process, doesn't mean that it doesn't happen.

Your broker will expect you to put something on the table.....the margin. Since your leverage is 1:100, you need to put 1000 eur on the table. This is about $1 180 depending on the EURUSD exchange rate. You will notice at the bottom of your trading platform it will say Margin :1 180. That is just a technical requirement so that you don't end up making trades of unlimited size.

Since we have borrowed 100 000 eur from your broker, of course, like any other loan, you need to pay interest on this loan. The current lending rate of the ECB is around 0.25%. which is 250 Eur per year, or 0.68 eur per day.

The trade is executed and you collect ZAR....1 574 000 at the time of writing(EURZAR rate). Of course now you are holding ZAR.....because you are holding the funds, which the broker holds for you, they pay interest to you. The overnight FX rate for the ZAR is 7.25%, so you collect R114 115 per year, or R312.64 per day. Converted back to EUR is 19.86. Now you can easily see that the difference between what you are paying and what you receive is 19.18 eur or converted to USD = $16.25.

So you are being paid $16.25 per lot for each day of open EURZAR trade that you carry. In fact, they call this the carry trade. It is a valid trading strategy. Of course the broker may take a cut and only offer you $13 and you can be sure that on the reverse trade ie BUY EURZAR instead of SELLING, then the broker will charge you far more than $16.25, probably more like $25 that you will pay the broker.

Also, just to be clear, swaps are not related to the profitability of the trade. If the trade has open profit or loss does not affect the swap collected or paid.

You can see the swaps in Metatrader 4 by right clicking on any currency, select Specification and scrolling down to swaps.

Swaps are quotes in points or in USD. I won't get into the complexity of calculating the actuals swaps but in the above example, you can clearly see that the broker charges more for long swap than what they pay for short swap.

Nice Article. Thank you for sharing the informative article with us. Stock Investor provides latest Indian stock market news and Live BSE/NSE Sensex & Nifty updates.Find the relevant updates regarding Buy & Sell....

ReplyDeleteL&T Finance

L&T Mutual Funds

Really best information ! useful to everyone thanks for sharing

ReplyDeleteCentral Depository Services India Ltd

Forex rebates for trades are trade-based and depend on your trading activity. For example, if a broker offers a certain percentage for every trade you make, you will be given back that percentage after every trade. ... These rebate bonuses really boost traders' profits and encourage them to keep trading.

ReplyDeleteGood broker with decent trading conditions. The option of opening a training account is very useful and helped me a lot when deciding to choose a broker. Assets are numerous, which is also a big benefit. Axim Trade

ReplyDeleteConvert Your USD TO ZAR In Real Time. Get The Most Current And Accurate usd to zar Exchange Rates Today.

ReplyDelete